When conducting community research there are two key ways that we can source respondents. Below explains the differences between these two methods to help you select the most appropriate one for your project (some projects will use both).

Representative Surveys

Purpose: to understand the whole community.

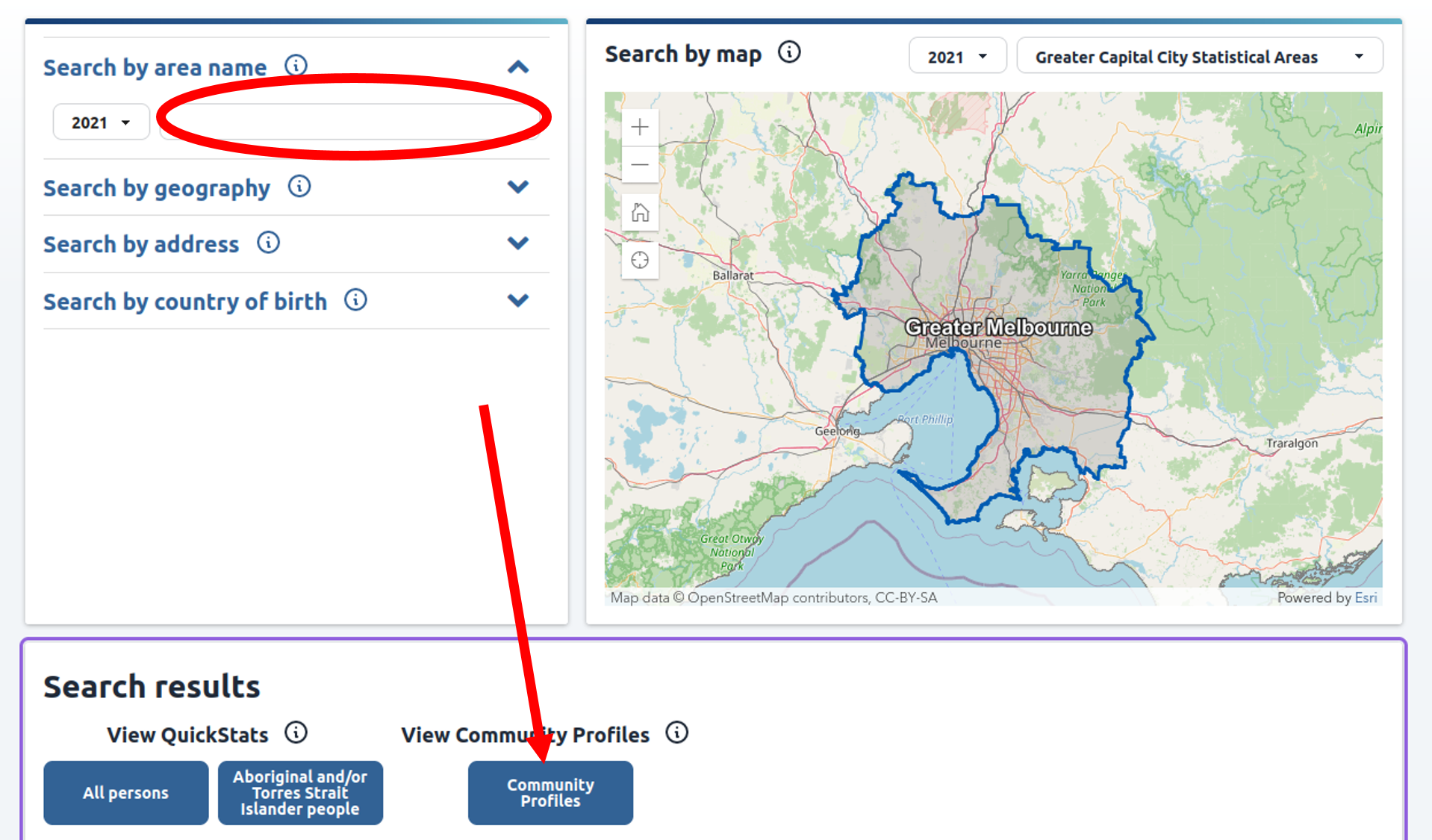

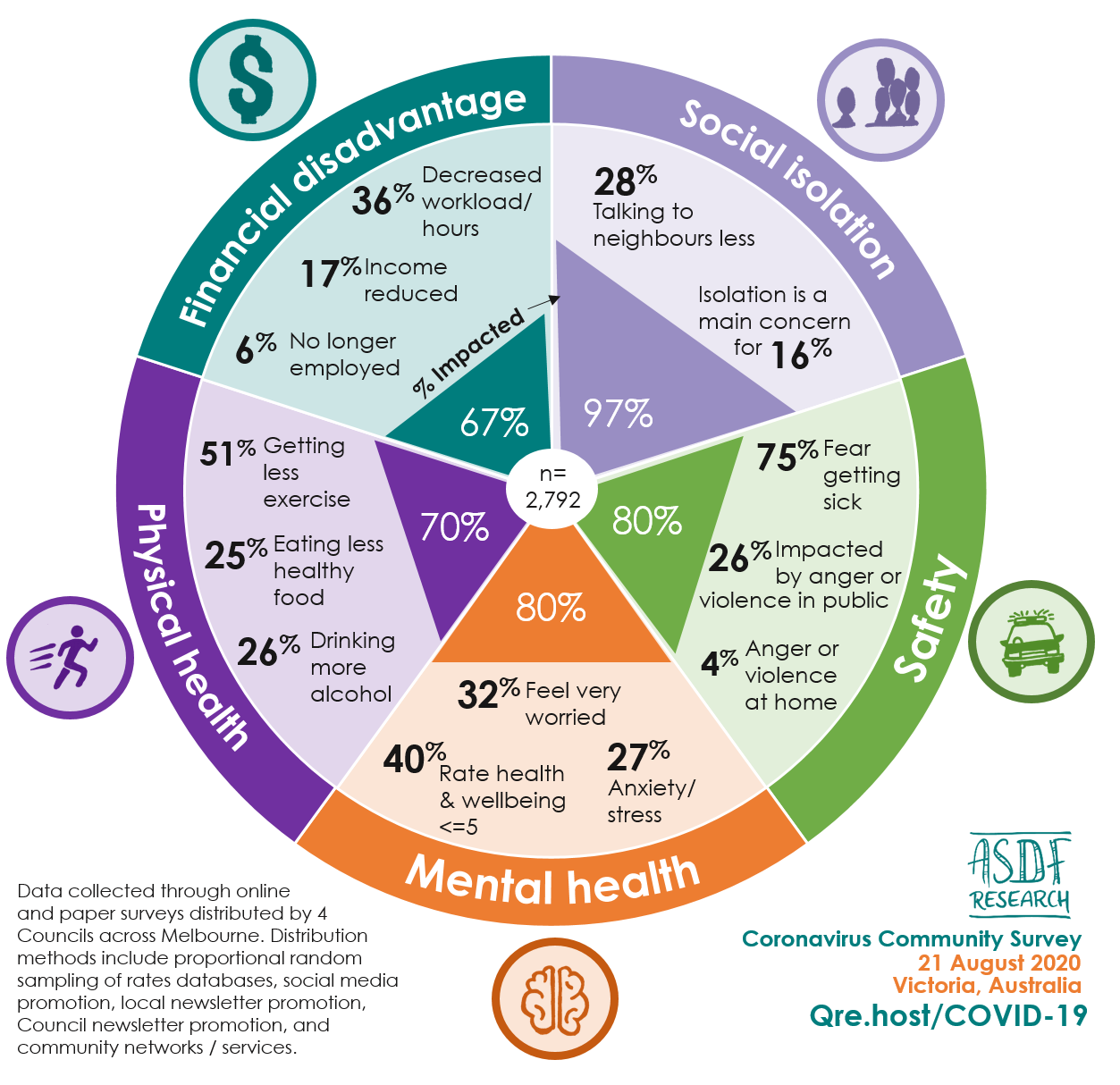

In a representative survey, we aim to get a snapshot of the entire community. This is done through a process called “sampling.” At ASDF Research, we work with Local Governments by using their rates database, which lists all households in the area. We randomly select a certain number of households from different geographic areas (like suburbs, small areas called SA1s, wards, or precincts).

These selected households are then contacted to participate in the survey. Since every household has an equal chance of being chosen, the survey results reflect a diverse mix of household types and cover the entire area evenly.

Use: Help understand the needs across the whole community, with the ability to compare findings across areas or demographics. This method is particularly useful at the early stages of planning, to help guide focus and scope.

Open Access Surveys

Purpose: to gather opinions from people interested in the topic.

An open access survey allows anyone who is interested in the topic to share their views. These surveys can be distributed in various ways, such as on Council engagement websites (like “Have Your Say”), social media, posters/signs in public places, or pop-up stalls at events.

Use: Help understand the needs, behaviours and opinions of those who saw the promotion and are interested in the topic. This method is useful to receive feedback on draft strategies and plans, to fine-tune the content.

Summary

Both methods have value, but perform different functions:

- Representative surveys are used to help understand the needs of the whole community, to guide the development of plans and strategies.

- Open access surveys are used to check in with those with an interest in the topic to fine-tune draft plans and strategies.

ASDF Research can help with all stages of this process, including survey design, sampling, distribution and analysis.